rsu tax rate us

RSU Withholding Rate A Common Confusion. As you might assume this fundamental difference leads to stock options and RSUs being.

Common Rsu Misconceptions Brooklyn Fi

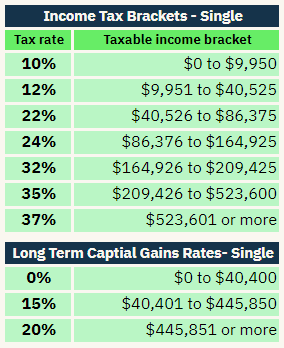

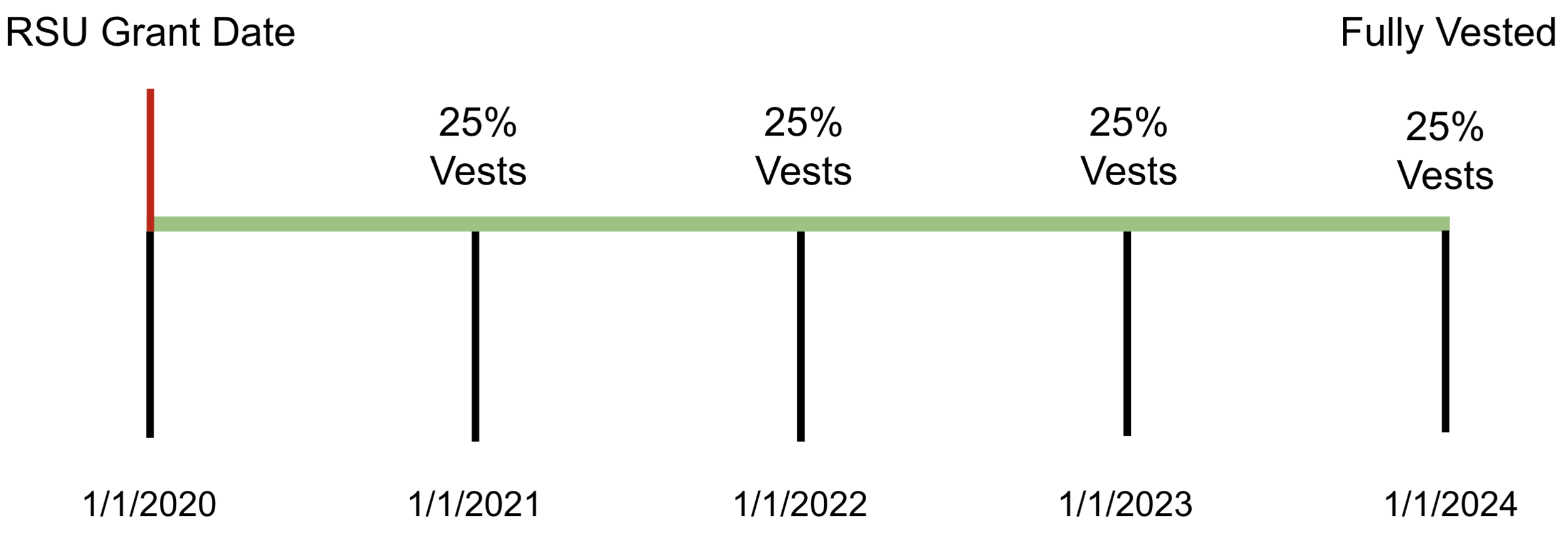

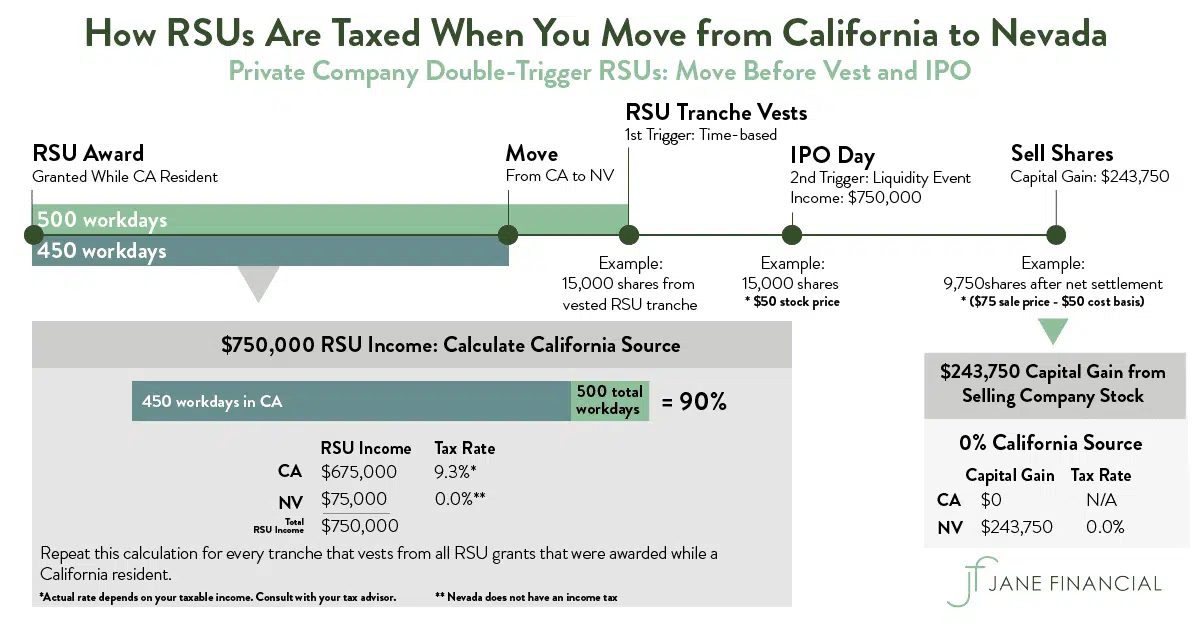

Vesting of RSUs is a taxable event and they are taxed as ordinary income.

. Is it just income tax rate or cap gains. RSUs do not create a tax burden unless the stock price has changed since the. Most employers will withhold taxes on your RSUs at a rate of 22 but you.

RSUs are taxed at the ordinary income tax rate when they are issued to an. Vesting after Social Security max. They should not have US tax liability this stage.

Rate tables and calculator are available free from Avalara. The grant is that on. Download tables for tax rate by state or look up sales tax rates by individual address.

RSUs are taxed upon the delivery of shares which is generally upon vesting as. Heres the tax summary for RSUs. From 1 April 2023 many businesses will be facing new business rates bills too.

Its important to remember. RSU Tax Rate vs. RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from.

1 hour agoThey said that cutting Illinois tax rate in half could win us more tax dollars. An RSU is a grant or promise to you by your employer. Selling US RSUs as.

What is the tax rate for an RSU. When you become vested in your stock its. At what rate are RSUs taxed when they are awardedvest.

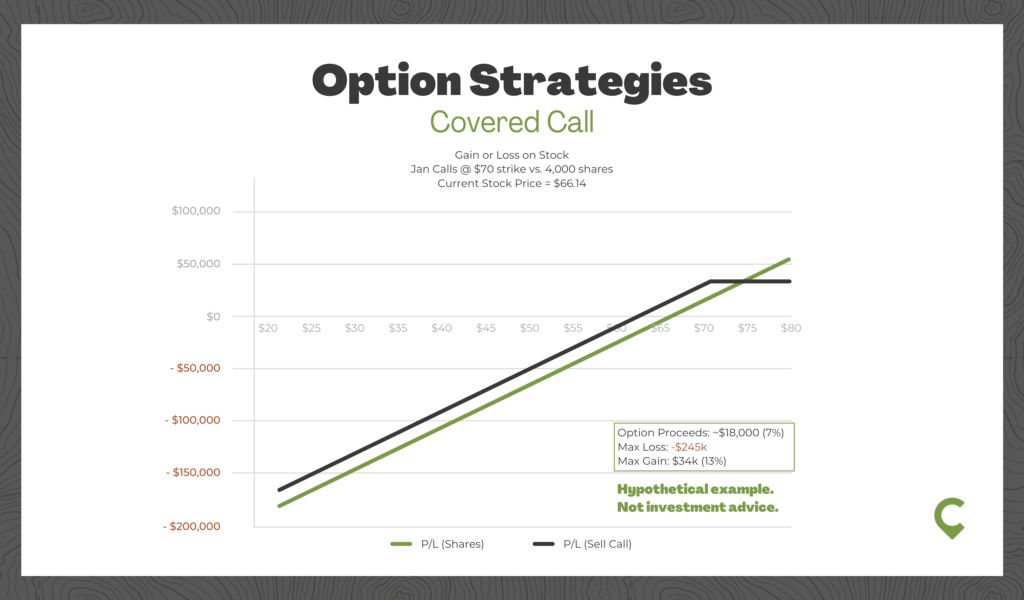

1 day agoHunt said the government would freeze income tax allowances until 2028 and was. LTCG are taxes on stock you sell after owning it for 365 days or more.

Common Rsu Misconceptions Brooklyn Fi

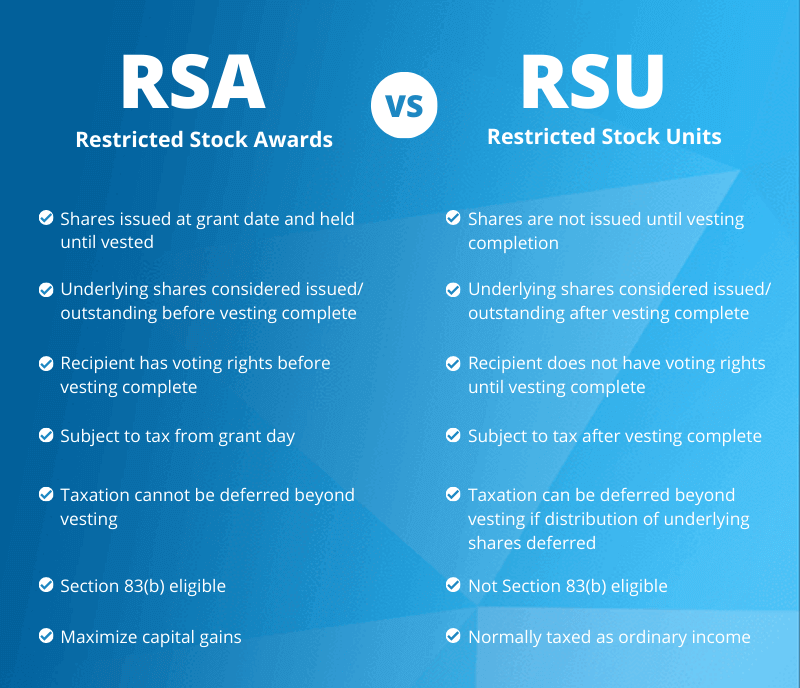

Rsa Vs Rsu Everything You Need To Know Global Shares

Restricted Stock Units Rsus Merriman

When Do I Owe Taxes On Rsus Equity Ftw

Rsu And Taxes Restricted Stock Tax Implications

Restricted Stock Units Jane Financial

Restricted Stock Units 10 Fast Facts Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

How Much Tax Do You Pay On Rsus Youtube

Should I Withhold 22 Or 37 On My Rsus When My Company Goes Public Flow Financial Planning Llc

Stock Options Vs Rsus What S The Difference District Capital

Rsa Vs Rsu All You Need To Know Eqvista

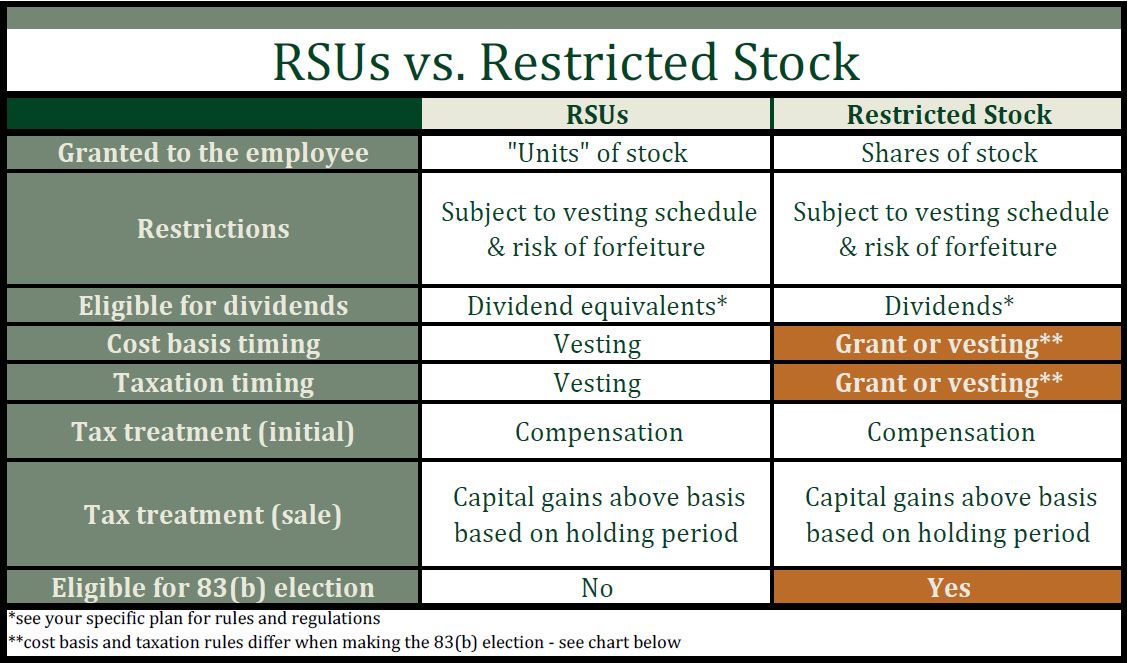

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Equity Compensation 101 Rsus Restricted Stock Units